Ten Alternative Energy Speculations for 2008: Batteries, CHP, and Transmission

This article is a continuation of my Ten Alternative Energy Speculations for 2008, with picks #8, 9, and10 published last Thursday. If you haven't already, please read the introduction of that article before buying any of the stock picks that follow. These companies are likely to be highly volatile, and large positions are not appropriate for many investors. My least risky picks (#8,9, and #10) are part of that same article; my most speculative plays (#1-3) will are here. #7 Electro Energy, Inc. (NasdaqCM:EEEI) $0.68 Electro Energy has risen 36% in the month and a half since I last...

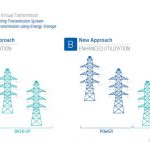

Energy Storage as Transmission Explained

by Blackridge Research

The latest trend is that power transmission companies around the world are increasingly looking at energy storage technology to defer or replace transmission system upgrades. How this works is energy storage is placed along a transmission line and operated to inject or absorb power, mimicking transmission line flows. Going with names like “virtual transmission” in Australia and “GridBooster” in Germany, projects totaling over 3 GW of capacity are poised to increase system efficiency and reliability across the world.

Storage as transmission offers an array of benefits over traditional transmission infrastructure. They are faster to deploy, have smaller footprint,...

Microgrids: The Electric BTM Line

by Joeseph McCabe, P.E. Which vendors at Intersolar 2016 in San Francisco supply the best behind the meter self generation microgrid solutions? I’ve asked similar questions about utility owned inverters, storage, and microgrids at previous Intersolars. This year I looked into the microgrid highest value propositions for photovoltaics (PV). What is a microgrid, and why they are coming of age now? A microgrid is a distinct electric system consisting of distributed energy resources which can include demand management, storage and generation. Loads are capable of operating in parallel with, or independently from, the...

Is AMSC Ready to Get Back to the Future?

Last week a jury found in favor of the United States government in a suit brought in 2013 by the Obama Administration against the Chinese wind turbine producer, Sinovel Wind Group (601558: Shanghai). Sinovel was found guilty of stealing technology from American Superconductor (AMSC: Nasdaq) that had supplied Sinovel with converter hardware and software solutions. Sinovel may have to pay hefty fines when the final sentencing step is completed in June 2018.

American Superconductor (now called AMSC) had already brought a private suit against Sinovel in China two years before the Justice Department filed its case. The China court dismissed the case for lack of...

Tres Amigas Proposes Three-way Transmission Link

by Michael Giberson If completed, the Tres Amigas project will encourage renewable power development and efficient power flows. Publicly traded wind power and superconducting cable company American Superconductor Corp. (Nasdaq: AMSC) is a large minority shareholder and the planned supplier. Tres Amigas LLC has proposed building a three-way superconducting HVDC link between the three separate power systems that span the United States and much of Canada: the Eastern Interconnection, the Western Interconnection, and the Texas (ERCOT) Interconnection. The three systems currently are linked by a small number of separate and relatively unimportant DC interties. The proposed three-way...

Comparing Electricity Storage and Transmission

Electricity Storage and Transmission are naturally complementary, and more of both will be needed. But given limited time and resources, where should those of us who want to see as much renewable electricity on the grid as soon as possible concentrate our efforts? The choice is not immediately clear. Dennis Ray, ED of Power Systems Engineering Research Center (PSERC) was quoted as saying “Regardless of contractual arrangements that are subject to environmental regulation, the ultimate dispatch pattern that will determine the actual emissions is largely dependent on transmission constraints and reliability considerations.” Horses for Courses At a basic...

Advanced Energy: Overlooked and Undervalued

Investors interested in renewable energy often get singularly focused on innovators new energy sources at the expense of companies that provide the nuts and bolts of the energy infrastructure. Advanced Energy Industries (AEIS: Nasdaq) is a stalwart of the electric power network, providing power conversion and control components that convert energy to the proper current for use by consumers and business. The company has a broad product line that has applications with a diverse customer base, including semiconductor manufacturers and chemical processing plants. The 2017 acquisition of Excelsys Holdings Ltd. based in Ireland added products targeted at medical and industrial applications.

As popular as Advanced...

Understanding Manufacturing Economics for Grid-Scale Energy Storage

John Petersen I have a new favorite word AGGREGATION! At the risk of sounding like a reporter, I’m going to summarize a pre-holiday news story you might have missed but need to know about. In late November the PJM Interconnect, the largest of nine regional grid system operators in the US, announced that it had begun buying frequency regulation services from small-scale, behind the meter, demand response assets in Pennsylvania. The first resources brought on-line by PJM were variable speed pumps at a water treatment plant and a 500 kW industrial battery array...

Hidden Gems? Why Green Investors Should Look at Daewoo Shipbuilding and Ener1

Part 2 of 2 Bill Paul Neither Daewoo Shipbuilding & Marine Engineering Co. Ltd., which trades OTC under the symbol DWOTF, nor Ener1 Inc., which trades on NASDAQ under the symbol HEV, is an obvious candidate for having hidden potential. Heck, Daewoo isn’t even a green energy stock. Or is it? Lost in the hubbub of Copenhagen and Congress, there’s been important news about both these companies that strongly suggests – at least to me – that each has plenty of undiscovered potential that will really start paying off over the next 18 to 24...

Comverge, Diverge, or Merge?

Tom Konrad CFA Comverge (COMV) has a great residential demand response business. The company lacks focus, but the stock has significant upside as an acquisition target. As part of my ongoing series on energy management companies (see these articles on World Energy Solutions (XWES) and EnerNOC (ENOC)) I spoke with Comverge CEO Blake Young. The Comverge Advantage Comverge is the strong leader in residential demand response (DR,) one of the most cost effective grid stability solutions. Even within demand response, residential DR is an excellent niche, because working in the market for residential DR...

The Case For Transmission, and Transmission Stock List

by Tom Konrad CFA We cannot choose between transmission and renewable distributed electricity. Local renewable generation requires long distance transmission to even out variations of supply. Hence, both advocates of distributed renewables and large wind and solar farms should support transmission improvements. Here are a few stocks which should benefit from such investments. Shortly after I launched Clean Energy Wonk, Blogger took the site down because I made the mistake of including both the words "Cheap" and "Free" in the title of an article about Energy Efficiency. Since it can apparently take up to 2 months for a human...

The Ontario Green Energy Act: What Can Alt Energy Legislations Do For Investors

Dedicated legislations have been at the core of some of the most impressive regional growth stories in alternative energy, most notably in Germany with the Renewable Energy Sources Act or in California with the various legislative solar initiatives. On Monday, the Canadian province of Ontario became the latest jurisdiction to join the fray as lawmakers introduced the Green Energy and Green Economy Act. Why should investors care? Because such legislations have been at the core of some of the most impressive regional growth stories in alternative energy. As a bit of a backgrounder on Ontario, there...

Powering Advanced Energy

by Debra Fiakas CFA Solar power producers have many challenges. One is the direct current to alternating current dilemma. Solar panels create power that flows one way in a direct current (DC). We use electricity in our homes and businesses in alternating current (AC) that flows both directions, forward and backward. So solar cell producers must use solar inverters that convert the electricity from the direct current in the solar panel into alternating current. This is where Advanced Energy Industries, Inc. (AEIS: Nasdaq) comes in. AEIS makes power inverters for the solar power industry. The...

Storage: The Best Renewable Energy Integration Strategy?

Tom Konrad, Ph.D. In order to electrify transportation, well need batteries, with ultracapacitors and compressed air playing supporting roles. Based on cost, John has been making the case that the batteries for economical cars are more likely to be advanced lead-acid (PbA) than the media darling, Lithium-ion (Li-ion.) I generally agree, especially since recycling Li-ion batteries is an expensive and difficult process, although I see a future where both cars and oil are simply more expensive, and we have far fewer of them. But transportation is only one application for energy storage...

ABB Group – A Cleantech Company?

Tom Konrad CFA Power and automation giant ABB, Ltd. (NYSE:ABB) was named Cleantech Corporation of the Year at the Cleantech Forum in San Francisco. The company has been focused on acquiring start ups in the cleantech space for the last couple of years, with two significant ones in 2010: Ventyx, a provider of IT systems to utilities, and Baldor Electric, the premier supplier of high-efficiency motors in the US. I very much like ABB's approach to cleantech. I'd even written about Baldor as a good way to invest in energy efficiency earlier in 2010 just a couple months before...

Ten Solid Clean Energy Companies to Buy on the Cheap: #2 National Grid (NGG)

Like Quanta Services, (#8 in this series), National Grid PLC (NYSE:NGG) allows investors to participate in the massive build out of electricity transmission and distribution infrastructure necessitated by years of neglect and the growing need to decarbonize our electric infrastructure. See the article linked above for more detail on these two forces driving the sector. Having its origins in British electricity deregulation in the 1990s, Nation Grid is a regulated utility in Britain and the United States, and operates high pressure gas pipelines and high voltage transmission in Britain, and electricity transmission and natural gas distribution in the Northeastern...