Green Energy Investing For Experts, Part I

Tom Konrad, CFA

You don’t have to be long Renewable Energy stocks to have a green portfolio. Shorting, selling calls, or buying puts on companies and industries which are heavily dependent on dirty and finite fossil fuels not only makes a portfolio greener, it can protect against the effects of a permanent global decline caused by peak oil.

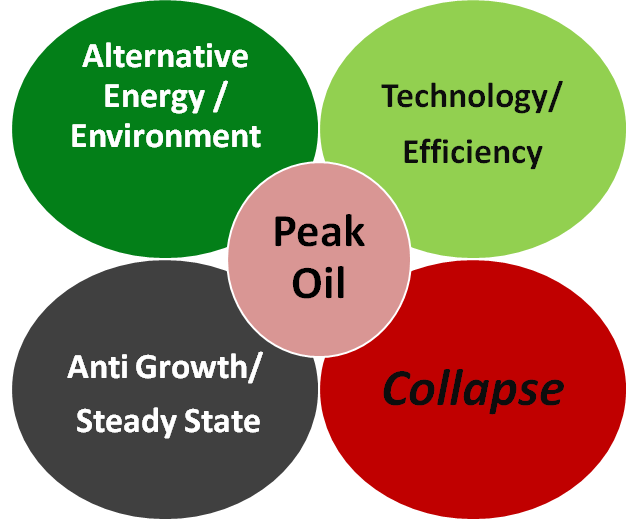

Nate Hagens presented this slide at the 2009 International Peak Oil Conference:

It shows his conception of the different schools of thought among those of us who understand peak oil. Those represented in the top two green circles believe that the economy can continue to grow, either through Alternative Energy or the more efficient use of resources, or both. The bottom two groups think our economy has grown so far beyond a sustainable level that it must shrink or collapse.

Nate thinks that any of these outcomes could happen, with differing probabilities. I agree, with the caveat that the chances of renewable energy technologies being effective enough to allow us to continue on our current growth path (the Alternative Energy/Environment option) is exceedingly unlikely due to limits in energy productivity (EROI and EIRR).

Market Consequences of No Growth

There are many speakers and writers far more eloquent than I who discuss the reasons and possible shape of a steady state, declining or collapsing economy. I’m not going to try to convince anyone that we’re near the end of economic growth. If you think it’s a possibility, you should consider what it will mean for your investments. If you still need convincing, try watching Chris Martensen’s Crash Course.

If the economy ceases to grow, or even declines or collapses, the stock market will do the same, only in an amplified fashion. The most concrete advice on what to do with your money usually involves taking some cash out of the banking system, and perhaps acquiring some physical gold. If there is a genuine financial system collapse, it probably does not matter what you did with your portfolio: what I’m going to talk about here is preparation for the Technology/Efficiency or Anti Growth/Steady State scenarios above.

If we do have a shrinking economy but our financial system does not totally collapse, it will be very important not to have a net-long position in the stock market. While I expect my favorite sectors to do relatively well in no-growth scenarios, even the most promising companies see earnings multiple contractions when markets fall as a whole. For centuries, stock markets have been priced under the implicit assumption of continuing economic growth. If investors begin to re-evaluate their investments under a new assumption of no growth or negative growth, we are likely to see average P/E ratios fall from the high teens where they are today well into the single digits. Even promising sectors will have to fall in sympathy to the lot, because they will need to attract capital that has many other suddenly more attractive opportunities.

How to Protect Yourself

If you see a substantial market decline as a real possibility, it makes sense to reduce your exposure. This is true even if you run the risk of missing out on substantial upside gains. The easiest way to do this is to sell stocks. While selling stocks is an excellent way to avoid losses, it will prevent you from profiting from your insights. The most valuable insights are those that are not yet widely shared. If you see changes in the economy coming, but most investors do not yet see them, you have a profit opportunity that need not be wasted even if it means that the stock market is headed down.

Instead, you can hedge your market exposure. By buying companies and sectors that are likely to do well during the transition, and taking short positions in companies that will probably be hurt, you should be able to profit if your predictions are correct. In future articles in this Green Energy Investing for Experts series, I will take a look at specific sectors and stocks that I expect to fare particularly badly.

In September, I wrote an article on hedging strategies, which included a simple technique for using a spreadsheet to monitor your overall market exposure, using only daily values and market index data. This technique is rough, and will only tell you your approximate exposure to market moves, but precise measurements of market exposure are unlikely to be much better. Markets tend to change over time, as do the relationships between them. Hence more sophisticated techniques are likely to give you more precise measures of your market exposure, but they are not likely to be much more accurate especially in times of market turmoil when you need them the most. Worse, the precision of such calculations can lend them an air of mystique, leading us to trust their accuracy much more than we should. In other words, to quote Warren Buffett, "It is better to be approximately right than precisely wrong."

Hedging Instruments

In the same article, I discuss a variety of ways to hedge. I’m not a great fan of pure shorts on individual companies because unexpected news events can cause any company to leap in price when you least expect it. My preferred approaches are:

- Buying puts. This is the only option in retirement accounts such as IRAs, and has the advantage that losses are capped at the amount of money you pay for the put. Buying puts is especially useful if you feel a company could be badly hurt in some future scenario, but may do quite well (or at least not badly) if that scenario does not materialize. Unfortunately, the hedging technique I mentioned above does not work very well with out-of the money puts, because the protection given by such puts is much higher than would be implied by their Beta.

- Short stock plus long call. By buying a long term, out-of the money call when you short a stock, you are protecting yourself against unforeseen large price rises. This technique is most appropriate if you expect the value of a company to erode slowly over time. New calls should be bought when old ones expire.

- Short call spread. This technique is similar to the short stock + long call option, but has the advantage that both positions can be chosen to expire on the same date. Furth

er, if the short leg of you call spread is near the money, and the long leg is far out of the money, you will end up making money even if the stock does not fall. You still will lose money if the stock goes up, however.

I tend to use a mixture of all three of these, depending on my expectation of the probability distribution for the particular underlying security. I will go into this in more detail when I discuss specific sectors.

About the Jargon

If you got lost in the jargon of the last section, please recall that you’re reading a series called "Green Energy Investing for Experts." None of these techniques are for the casual investor. If you got lost, and still think you want to try these techniques, you will need to get options trading authority from your broker, as well as learn the ins and outs of your chosen option strategy. The safest and easiest strategy to start with is buying puts.

To learn more, get yourself a comprehensive book on options and option strategies, or commit to spending a good chunk of time with several of the web option primers. If you are just learning, start small.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Tom,

This is not related to the article, but I was curious if you had any thoughts on Guangshen Railway Company (GSH).

I know you all occasionally write about rail stocks, but wasn’t sure if this one fell into your niche. I couldn’t find a mention of it on the site (via the search engine).

Jake,

I generally consider rail to be part of transportation efficiency (which should be a large part of a green energy portfolio,) but I prefer passenger rail to freight rail because freight is often heavily dependent on coal.

I have not looked at GSH in particular.